Does Refinancing A Car Hurt Your Credit

In order to issue the new loan the lender will probably make a hard credit inquiry. Auto refinancing just like any type of refinancing has the potential to affect your credit scores as calculated by the FICO Score and VantageScore scoring models.

Awesome Getting A Car Loan With No Credit History People Euro Media Check More At Http Ukreuromedia Com En Pin 3245 Car Loans Car Insurance Credit History

Potential effects of refinancing on credit health.

Does refinancing a car hurt your credit. Refinancing your car will hurt your credit in the short-term but your scores will improve after making on-time payments on your new loan. Or you might wonder Does refinancing a car hurt your credit Yes it can. When you apply for new loans including refinance loans creditors will run your credit reports which results in new hard inquiries.

And Indeed a refinance car with bad credit score issue is among a matter you should be learn in. An auto refinance could negatively impact your credit. But because refinancing can negatively affect your credit score its important to carefully weigh the benefits versus the costs before you start shopping for a new loan.

However you will need to know how does refinancing a car hurt your credit especially if you are planning to take a bigger loan in a few months. It will however change it just a little. Surprisingly refinancing your auto loan is one way to deal with the situation.

Refinancing means taking on a new loan to pay off your existing car loan. The new loan will affect your average age of accounts and credit utilization. Lets dive deeper into how refinancing an auto loan may hurt your credit.

The good thing about this option is that it offers double the benefit by making your car payment more affordable. Hard inquiries typically lower your credit scores by a few points. For more details read How to Refinance a Car.

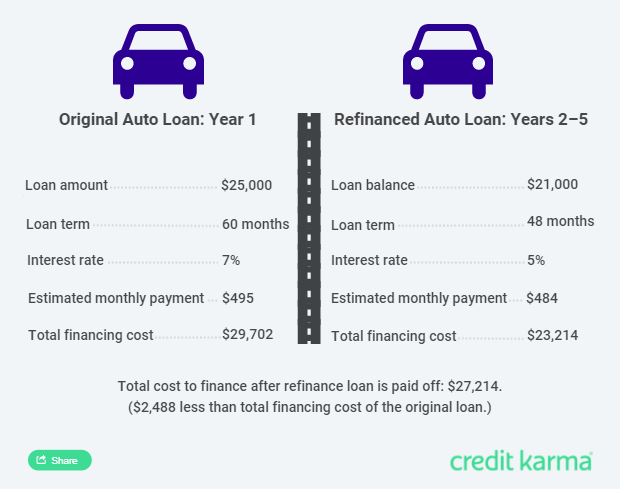

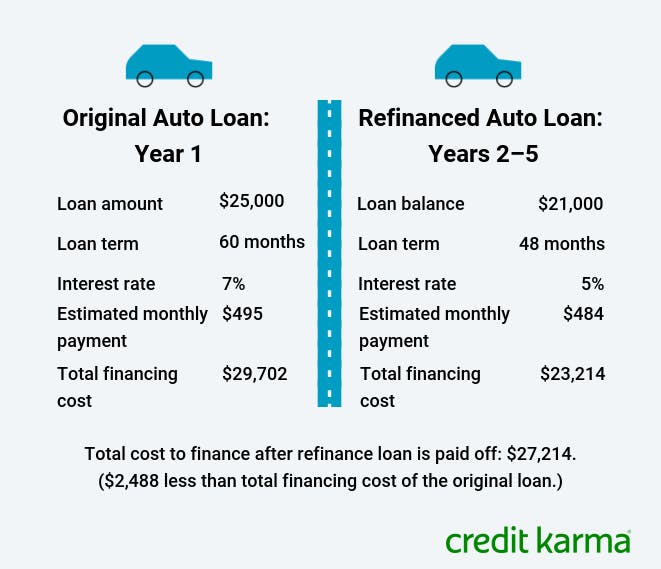

Refinancing your car loan can be an ideal way to save money and even shorten the length of the loan. The good news is that yes you can often refinance your car even with bad credit. To do this theyll likely pull a hard inquiry which may bring your credit score down by up to five points.

Doing so can be a good idea especially if you can get a cosigner whose credit is in good standing if your. Refinancing a car can hurt your credit for several reasons. Let us explain the ways it can help repair your bad credit.

Even though refinancing isnt a big threat to your credit score you can still minimize its effects with careful planning. Refinancing your auto loan closes your old car loan and adds a new car loan to your credit report. Read on for the lowdown on how refinancing car loans can affect your credit.

Refinancing might lower your credit score by just a few points but thats inevitable when shopping for a new loan or credit account. How refinancing affects your credit score. If youre considering applying for a mortgage or that really exclusive credit card youve had your eye on you may want to hold off on an auto loan refinance to keep your scores as high as possible and maintain your chances of being approved.

The reality however is that refinancing can hurt your credit because lenders will assess your creditworthiness or how worthy you are to receive credit. Even Youre not an staff a refinance car with bad credit score is crucial for just about any applications if you want to deliver a proposal to other Firm firm and even your Instructor. In reality refinancing a car loan wont hurt your credit.

But in some cases it might be the best or only option for when things go sideways. Thats because your original car loan will be paid off early and replaced by a new auto loan. A car loan refinance also might hurt your credit by reducing the average age of your accounts.

Because refinancing replaces an existing loan with another of roughly the same amount its impact on your credit score is minimal. Applying for several different types of loans can drive down your credit score faster than if you were focusing solely on doing a mortgage refinance notes David. Juggling multiple new loans.

You may worry that refinancing your car will hurt your credit. If the scoring model weighs closed accounts less than open accounts the payment history portion of your credit score could be slightly affected since the payment history on the old loan may now carry less weight. Refinancing a mortgage auto loan personal loan or other loan can help lower your interest rates reduce your monthly payment and give you more wiggle room in your budget.

If you qualify for and accept a loan offer youll typically see another small score dip. Refinancing a Car Can Temporarily Lower Your Credit Score.

How Does Refinancing My Car Loan Affect My Credit Rategenius

What Credit Score Do I Need To Refinance My Car Loan Rategenius

Will Refinancing A Car Hurt Your Credit Nerdwallet

How To Refinance Your Car Loan With Bad Credit Credit Karma

Refinancing Your Home When Your Credit Is Less Than Stellar Can Hurt You In The Long Run Get More Tips For Refinancing Your Refined Selling House Home Buying

Refinance Your Car Loan Estimate Your Savings Calculator

Will Refinancing A Car Hurt Your Credit Nerdwallet

Does Refinancing A Car Hurt Your Credit Self Credit Builder

When Does Refinancing A Car Loan Make Sense Credit Karma